Table of Contents

Long Island Special Needs Planning Attorney

It is essential that you carefully prepare your estate plan when you or a loved one has a disability. A special needs trust is a trust that is established for a person with special needs that receives government benefits or may have the need for government benefits in the future.

While owning a home, a vehicle, or normal personal effects will not affect a disabled person’s ability to receive Supplemental Security Income or Medicaid benefits, cash in the bank will adversely affect those benefits. Maintaining assets in a valid special needs trust, instead of in the disabled person’s own name, the disabled person can receive benefits while still enjoying additional funds held by the trust. Since the person with special needs has no direct control of the assets placed in a special needs trust, the assets in the trust are disregarded by Medicaid and SSI for purposes of program eligibility.

If you have a disability that would entitle you to government benefits, you may benefit from special needs planning. If you are already receiving government benefits and receive money either through an inheritance or lawsuit settlement or judgment, you may need special needs planning to ensure that your benefits are not jeopardized.

If you have a loved one with special needs, then setting up a special needs trust as a part of your estate planning can help you ensure your loved one is well taken care of after your death and prevent undue hardship to him or her. Without any planning, if the person who inherits your estate by law is receiving government benefits, then when he or she is mourning your loss after you die, your loved one will be confronted with the risk of losing his or her benefits and the hardship of dealing with special needs planning in what is already a difficult time.

Rather than leaving assets directly to your loved one, disinheriting him or her completely, or worse of all, not planning at all, property can be left to a special needs trust, where it is overseen by a trustee of your choice, ensuring your loved one is left with money while preserving his or her government benefits. Therefore, it is important for not only a person with a disability to plan for themselves, but their relatives must be sure that their own estate plans include special needs planning to ensure that a disabled person’s benefits are not jeopardized and he or she does not suffer undue hardship in a time of loss.

If you or a loved one has a disability, it is important that you have a highly experienced attorney in special needs planning who can help you create the best plan, which may include a special needs trust specific to your unique situation. When you contact Esther Schwartz Zelmanovitz, PLLC, you will speak to a highly knowledgeable attorney who will carefully consider all the specifics of your situation. Attorney Esther Zelmanovitz is passionate about finding strategic, creative solutions to her clients’ problems, representing those who need guidance to help them through a confusing or complex legal situation. Esther Zelmanovitz will help you get your affairs in order while ensuring you and your loved ones are protected at the same time.

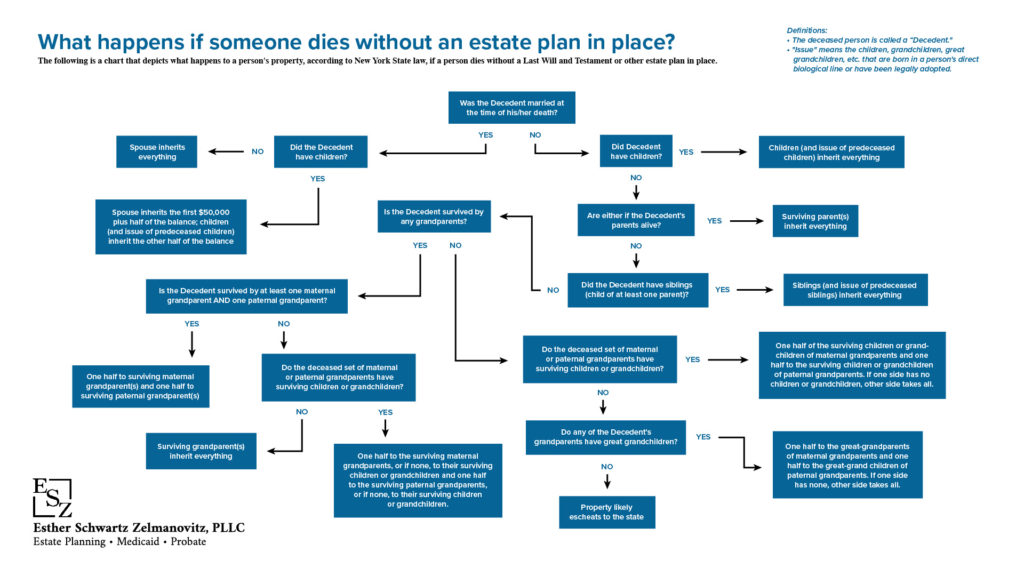

What happens if someone dies without an estate plan in place?

CLICK TO DOWNLOAD THE FULL CHART.

Determining Which Special Needs Trust is Right for You

Essentially, there are two types of special needs trusts: a first-party special needs trust, and a third-party special needs trust.

First-Party Special Needs Trusts

A first-party special needs trust is funded with a disabled person’s own funds, while a third-party special needs trust is funded with someone else’s money to provide for the person with a disability, ensuring he or she is taken care of after the death of the caretaker. The most important difference between a first-party special needs trust, and a third-party special needs trust is what happens to the property when the beneficiary of the trust dies. A first-party special needs trust must include a “pay-back” clause, requiring the trustee to use the remaining assets in the trust to reimburse Medicaid for the benefits paid out to the special need’s beneficiary.

Third-Party Special Needs Trusts

A third-party trust does not have such a requirement, and after the death of the special need’s beneficiary, the remaining trust assets can be distributed to the named beneficiaries. For this reason alone, it is crucial that when a person has a loved one with special needs that may inherit from their estate, they should prepare a third-party special needs trust for the loved one in advance to avoid either the loss of government benefits or the payback requirement of a first-party trust. A third-party special needs trust can be included in the Last Will and Testament or another trust created for another purpose or can be drafted to stand alone.

When there are multiple donors who wish to fund the special needs trust, a stand-alone special needs trust may be more useful and efficient, as it exists during the lifetime of the person who establishes the trust, as well as after his or her death. Multiple people can direct gifts to a single stand-alone trust. For example, if one stand-alone special needs trust was set up by a disabled person’s parents, contributions to the trust can be made by grandparents, aunts, uncles, and siblings, either during their own lifetimes, or as a bequest in their own will or other testamentary planning. A special needs trust included in a person’s will is only funded once the testator dies and can only be funded by the assets in the testator’s estate as directed in the will.

Additionally, there is a pooled asset trust available when a disabled individual inherits or is awarded money that is in excess of the Medicaid or Social Security Income (SSI) limit. Upon receipt of the funds, the individual would deposit the lump sum amount into the pooled asset trust administered by a not-for-profit organization. This will allow the disabled person to avoid disruption of public benefits while being able to use the trust money to pay for their own expenses. The assets remaining in a pooled asset trust is paid over to the not-for-profit organization upon the disabled individual’s death.

Why Should I Establish a Special Needs Trust?

There are a number of compelling reasons for establishing a special needs trust for a disabled loved one or for oneself. These reasons include:

- Allows a disabled loved one to receive lifestyle supplementation without jeopardizing government benefits. A disabled person can obtain basic support funds from Supplemental Security Income, which then leads to eligibility for Medicaid and other government programs. SSI, however, will only cover essential expenses, and while a parent might want to supplement their child’s lifestyle, SSI imposes strict limits on assets and income. The solution, then, is to place assets in a special needs trust, so those assets will not be counted as income for determining eligibility for benefits.

- Allows other people, such as grandparents, to contribute to the care of an individual with special needs. Establishing a special needs trust allows others who also want to help the disabled person to make annual gifts up to $15,000 per year, without triggering a generation-skipping tax or a gift tax.

- Allows you peace of mind, knowing the assets will be used as you intended. When you create a special needs trust, you can rest easy, knowing your disabled loved one will be taken care of long after you are gone. When you leave assets to another person with instructions to take care of the special need’s individual, many things could happen to prevent that. The person may not honor your request, or even with the best intentions, the assets could be lost to creditors, in a divorce, or the person could die prematurely, resulting in the funds being inherited by someone else.

- Allows you to clearly identify distributions. When a special needs trust for your child is established while you are alive and able to administer the trust, the trust can be used to pay the necessary expenses for your child. After your death, the named successor trustee can refer to your prior payments to determine the appropriate use of the funds.

- Allows you to fund the special needs trust in the way you choose. Securities, cash, and other resources, such as a second-to-die life insurance policy, can all be used to fund the special needs trust. A retirement account can also be used to fund the special needs trust, however, it is important that you speak to an attorney who can advise you on the most tax-efficient way to transfer retirement funds to a special needs trust.

- Allows benefits from a personal injury settlement to be maximized. When a disabled child receives a settlement from a personal injury claim, the person can have the settlement directed to a first-party special needs trust; this allows the individual to receive regular payments for life, while still qualifying for public benefits.

- Preserves your inheritance and your Medicaid and/or Social Security Income benefits. When a disabled person receives an inheritance outright, the person can direct the inheritance to a first-party special needs trust; this allows the individual to enjoy the inheritance for supplemental needs while avoiding loss of public benefits.

Getting the Help You Need for a Special Needs Trust from Esther Schwartz Zelmanovitz, PLLC

If you have a child with special needs or other special needs beneficiary, having a special needs trust or supplemental needs trust is essential. If you have a disability and are receiving public benefits, a special needs trust may make the difference between keeping or losing your benefits if you inherit money or receive a personal injury settlement. When proper planning is implemented, you can ensure the financial future and support to live comfortably is preserved, while maintaining eligibility for government benefits.

Esther Schwartz Zelmanovitz, PLLC can provide the necessary guidance in setting up and administering a trust, while coordinating estate planning efforts to enhance and enrich the life of a special need’s individual. Esther Schwartz Zelmanovitz serves her clients in Long Island, as well as all five boroughs of New York City and statewide, offering home visits and evening appointments when necessary. Contact Esther Schwartz Zelmanovitz, PLLC today for a comprehensive evaluation of your situation.